Articles in the Your Financial Fitness Category

Account For Change, Your Financial Fitness »

“Student loan debt amassed by parents is growing faster actually than loans taken out by the student. Parents’ loan debt has more than doubled over the past decade exceeding $100 billion. That’s 10% of all student loan debt, and that’s according to Fastweb.com and Finaid.org.” – reports CNBC‘s Sharon Epperson.

“Parents of every income level are increasingly borrowing for their children’s college educations,” says Fastweb.com & Finaid.org publisher Mark Kantrowitz.

Whatever your particular situation, do your homework, research your options: scholarships, grants, and other financing programs available at little or no cost. …

Account For Change, Taking Stock, Your Financial Fitness »

Beginning July 1, the 401(k) providers must begin disclosing fees; plus, there are some new proposals “coming out from the treasury department that may have an even greater effect for retirees who want a secure income stream for life.”

“New 401K options and greater transparency over fees are designed to give workers and retirees more control over their retirement savings.”

CNBC’s Sharon Epperson reports.

(video 3:03)

Account For Change, Your Financial Fitness »

Private equity firms want to go out and buy up foreclosed properties, REOs (real-estate owned or bank-owned) properties. There are millions of foreclosed properties that need to be resolved, and investors want to buy them in bulk and rent them. The government is talking about selling them in bulk; although no plan is out yet, the talk is that it’s coming.

Investors want to come in and buy these homes nationwide, rent them, and manage them.

“We look at managing it through sort of a distributed apartment-building model; and we’ve built …

Taking Stock, Your Financial Fitness »

It is imperative to understand how the marketing and advertising in the (retirement fund, mutual fund) industry works, so that your money is invested in the best investment vehicle for your particular individual profile: your financial situation, your risk tolerance, your time horizon, your investment objectives, to name a few concerns.

Equally important is the consideration as to whether your money is best invested in an actively-managed fund vs. an index fund, especially while taking into account the fund fees that are charged, often obscurely, that can make a huge difference …

Account For Change, Your Financial Fitness »

“The housing market has become less bad than it was,” says Barry Habib, RPM Mortgage chief strategy officer; but is this really the case? This is one man’s viewpoint, and it is our responsibility to draw our own conclusions. The following two videos offer some current information and insight into the status of the housing market plus some predictions of what the housing situation might be in the year(s) ahead. Remember, predictions are merely forecasts, not any guarantee!

(video 10:22)

(video 1:48)

Account For Change, Headlines, Your Financial Fitness »

“How healthy is the American workforce, and what can you expect in 2012 if you’re looking for a job?” – A conversation with workplace guru Daniel Pink, author of Drive, to get his predictions on what jobs are needed going forward; what jobs are becoming obsolete; how risk is shifting from the corporations to the individual – pensions, health care, education; the trends toward skills and abilities that are harder to outsource and automate; and, how our nation’s policies are not keeping pace with these transitions and the irrelevancy of …

Account For Change, Your Financial Fitness »

“From now thru end of 2014, or even 2015, there are going to be over a million properties that are bank owned, in other words, REO properties. And what that tells you is, at least from the supply side, is that there’s an enormous amount of housing that is out there ready to be consumed, so to speak. And unless there’s a corresponding increase in demand, you can count on the fact that house prices will be under serious downward pressure.”

Translated into losses in terms of the national average that you …

Account For Change, Your Financial Fitness »

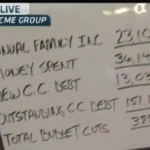

Understanding the US debt in terms of the average American family budget, reminiscent of the movie Dave.

“Think back to third, fourth grade math, things like reducing fractions, common denominators; that’s how we’re gonna make trillions make sense,” says CNBC’s Rick Santelli; who looks at the national debt clock, total U.S. tax revenues, and the U.S. budget to make sense of the numbers by itemizing them in terms of the average American family budget.

(video 1:47)